Legacy Design Strategies

Omaha, NE, Minot, ND and Iowa Fall, IA Estate Planning and Elder Law Firm

Estate Planning and Elder Law Blog

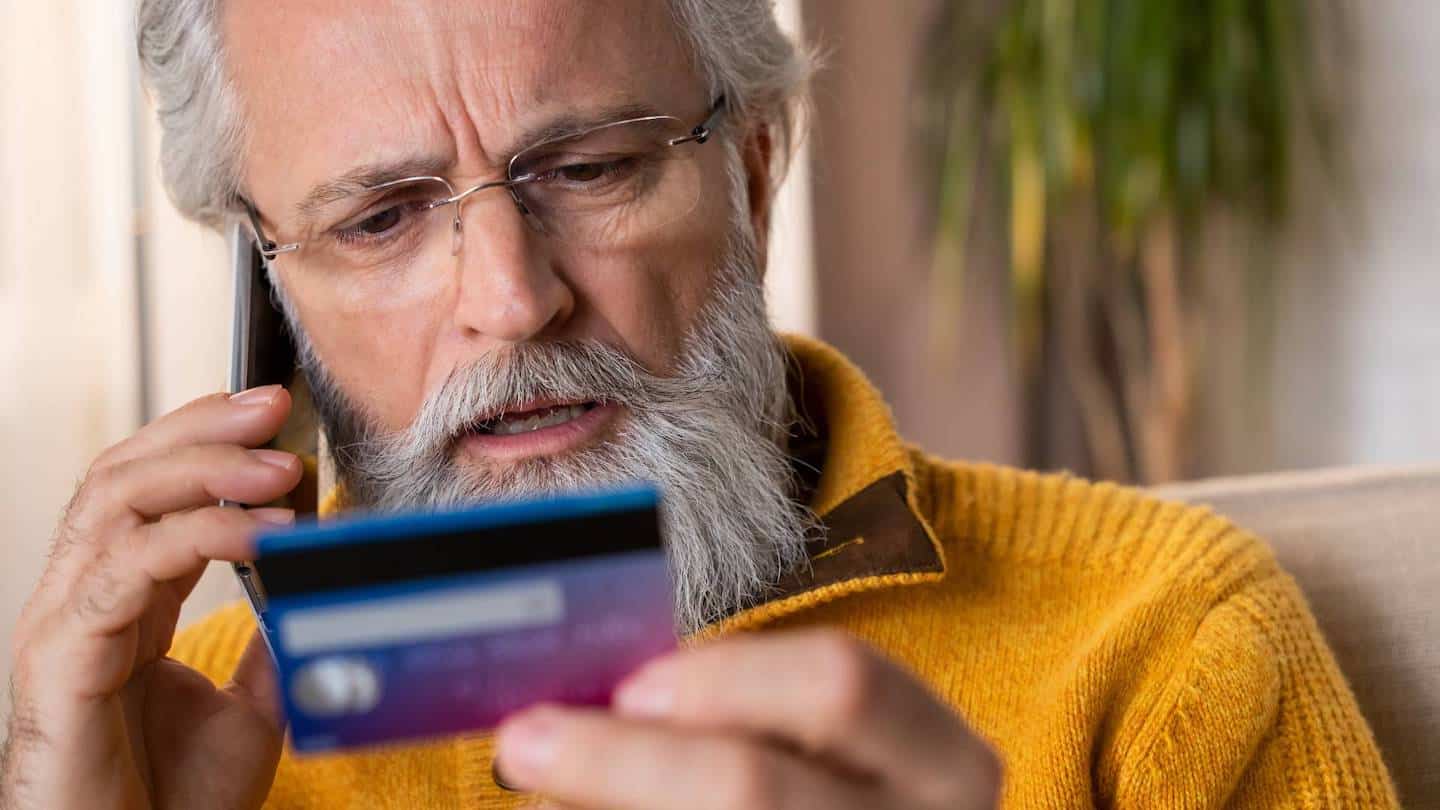

Thinking on a very practical level, if you were a thief and had to choose a target, it would likely be someone who has wealth and is vulnerable—the picture of an elderly person, especially one who is likely to be isolated and may have cognitive issues. According to the Federal Trade Commission, consumers aged 60 and older filed 467,340 fraud reports in 2021, reporting total losses of more than $1 billion.

A recent article from cbsnews.com, “How to protect elderly parents from financial scams,” says that consumers age 60 and older are less likely to report losing money to fraud than those aged 18—59. Still, when they do report a loss, it tends to be for more money, especially among those 80 and older. They have the highest median loss of all groups.

Older adults in states like North Dakota, Iowa, and Nebraska are likelier to lose money on scams involving tech support, prizes, sweepstakes, lotteries and friends and family impersonations. What can you do to protect your elderly parents against scammers?

Talk about it. Scams target everyone. Therefore, it is an easy topic to bring up. First, start the conversation with your experiences or a trending news story. Next, explain specific scams, like someone reaching out through social media saying they want to be friends, followed by an urgent request for money or fake text messages from a grandchild who needs bail money. People informed about scams’ specifics are less likely to respond.

Use anti-fraud tools. Spam-blocking apps on cell phones can send unknown numbers to voicemail immediately. A credit freeze can secure credit information and is easily temporarily unlocked for legitimate access. Setting strict privacy tools on social media can also limit the number of scammers who can get through.

Signing up for financial account monitoring or receiving alerts for transactions is easily enough put into place. However, in some instances, it would be wise to allow adult children to monitor these accounts, depending upon the parent’s comfort level with sharing this information.

Put legal tools into place. A durable power of attorney, revocable trust, or, if appropriate, guardianship, can be among the most effective ways to keep an older adult’s assets safe from scammers. If a revocable trust is created, an adult child can quickly step in before too much damage is done, whether it’s a fake charity or a “kidnapped grandchild” scammer.

Know the warning signs. An older adult who is suddenly reluctant to talk about their finances had said they are having trouble paying bills when they never had a problem before or is receiving a high number of text messages or phone calls and insists on being alone when they respond may have become a victim of fraud.

Scammers are especially good at creating a sense of urgency, saying their victims must send money or gift cards immediately, or the IRS or police will arrive at their door. The latest wrinkle is the use of artificial intelligence to mimic a loved one’s voice, and the technology is so good that even experts are fooled. Our article, How To Avoid Senior Financial Abuse provides additional strategies specifically related to financial elder abuse.

Avoid shaming loved ones. The embarrassment of being the victim of elder financial abuse worsens a bad situation. Don’t scold an elderly person for being fooled; they certainly will be angry enough at themselves for being taken. Reassuring words are more likely to allow the victim to keep some of their dignity, while encouraging them to call you if, and more likely when, they are confronted with another scammer.

If you are worried about your elderly parents or believe that they may have been victims of fraud, it's important to help them investigate the issue and protect their financial accounts. Our team of elder law specialists at Legacy Design Strategies cares deeply about providing elderly people and their families protection and a sense of relief when guarding assets. Schedule a free call today to discuss ways we can help guide your parents. You can also learn more about our work that can help to protect your elderly parents from scammers in our masterclass: How To Get The Best Nursing Home Care For A Loved One — While Protecting Your Nest Egg.

Reference: cbsnews.com (April 10, 2023) “How to protect elderly parents from financial scams”

Get Started Today

Book your Free Estate Planning Consultation Now

Stay Up-To Date

Subscribe to Our eNewsletter

9859 South 168th Avenue,

Omaha, NE 68136

7 Third Street SE, Suite 202,

Minot, ND 58701

320 North Oak Street, PO Box 295,

Iowa Falls, IA 50126